Market volatility and ongoing economic uncertainty present financial advisors with a clear challenge: How do you build portfolios that protect client assets, drive growth and manage risk effectively? With the rising interest, private markets have emerged as a compelling source of potential long-term returns. However, their inherent illiquidity has traditionally limited their role in portfolio construction, especially for individual investors.

This is beginning to change. Advisors who adopt a disciplined, risk-aware approach to private market allocations can help build stronger, more resilient portfolios, to serve both existing clients and the next generation of investors.

The Case For Private Markets

Private markets provide the potential for higher returns and have historically shown lower volatility than public markets. But these benefits come with a critical tradeoff: limited liquidity. This risk can be managed by selecting experienced managers with a proven track record and by building allocations that are well thought out.

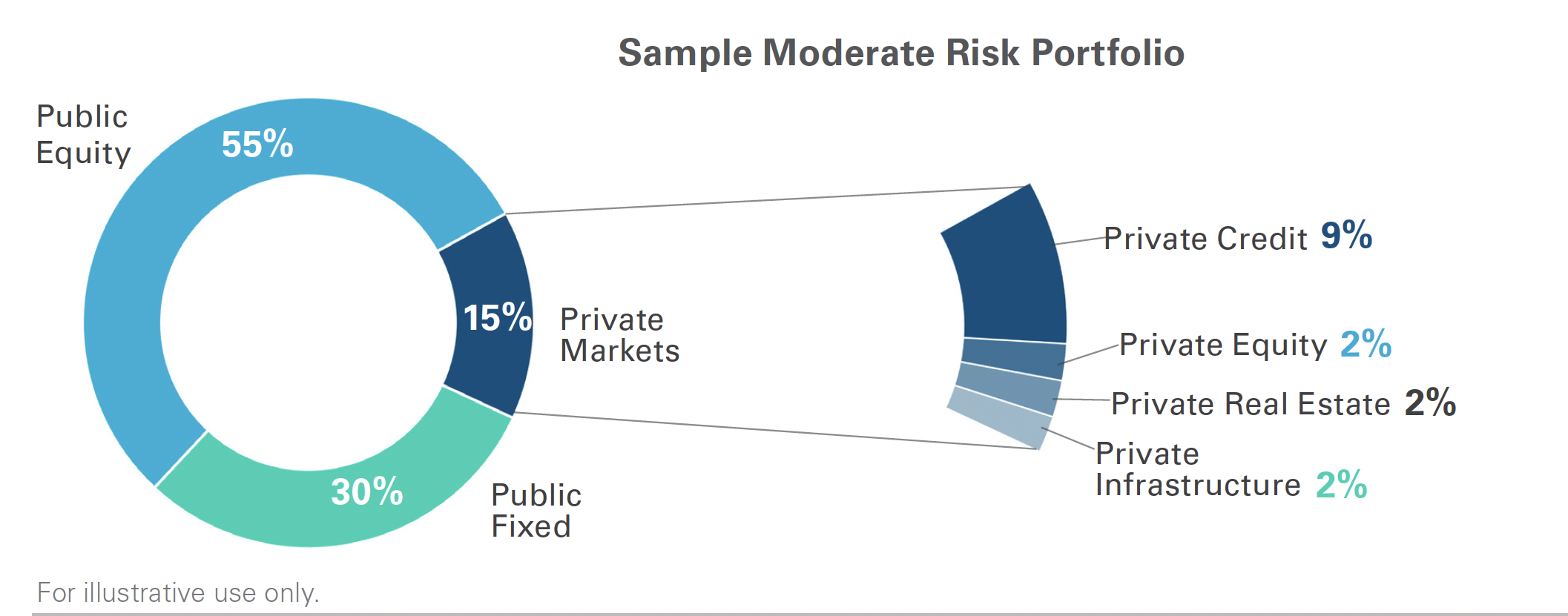

Traditional models often define risk through volatility alone. Yet it is critical to account for both volatility and illiquidity. AssetMark’s research suggests that an allocation of around 15% to private markets can capture much of the return and diversification benefits without introducing excessive illiquidity, even during periods of market stress, as demonstrated in the following example.

A Sample Portfolio In Practice

The Sample Moderate Risk Portfolio is designed for a client who typically holds a traditional 60/40 mix of public stocks and bonds. This portfolio reallocates 5% from public equities and 10% from fixed income to create room for private market exposure. Most of these investments are directed to private credit, valued for its high expected Sharpe ratio – a measure of return relative to risk – and more consistent cash flows. Smaller portions are allocated to private equity, real estate and infrastructure, which add further diversification and elements of inflation protection.

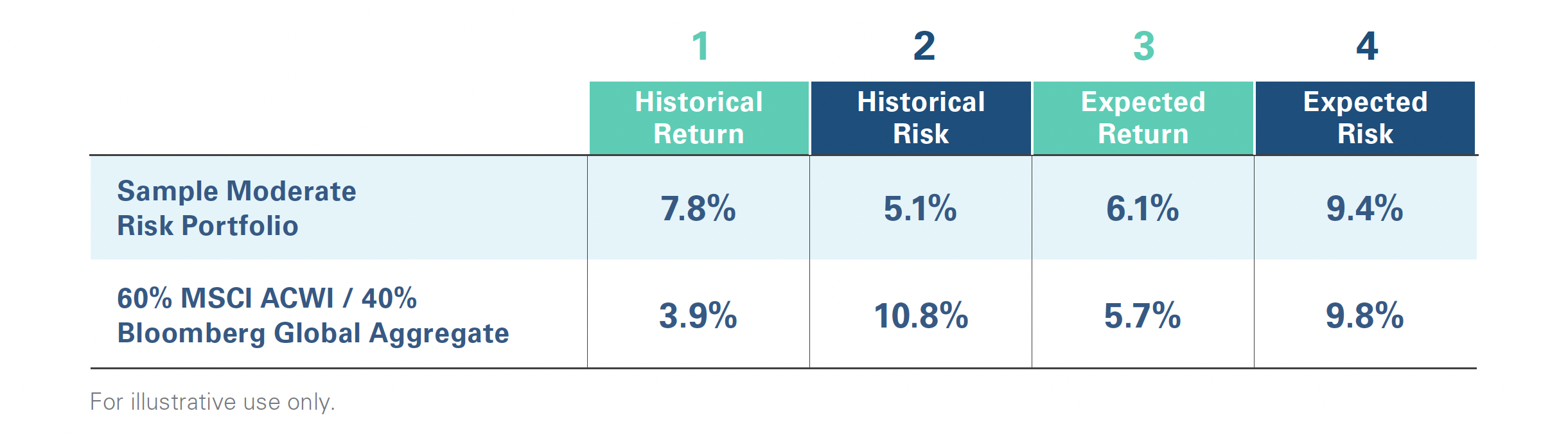

Because the volatility of the private market allocation is closer to public fixed income than to public equity, the reallocation is sourced more heavily from the public fixed income portion of the portfolio. Compared to a traditional 60/40 benchmark, made up of 60% MSCI ACWI and 40% Bloomberg Global Aggregate, the portfolio with private markets is expected to deliver higher returns with lower volatility.

We used conservative assumptions in our forward-looking capital market models, so the projected performance advantage may appear modest. However, over time, even small improvements have the potential to compound into meaningful long-term results.

Which Clients May Want To Consider Public Markets?

Private markets are not right for every investor. For clients with a longer time horizon, tolerance for illiquidity, and a desire for diversification, private markets can serve as a complement to public markets by providing the potential for enhanced returns and reduced volatility. Clients who are well suited for private market allocations typically have investment horizons of seven to 10 years or longer, limited liquidity needs and a goal of reducing exposure to public market volatility.

Advisors can guide clients more effectively by helping them understand the value of the illiquidity premium, setting realistic expectations around distributions and aligning investments with long-term goals. It is important to position private markets not as a short-term tactical move, but as a strategic, long-term component of a comprehensive wealth plan.

It is important to position private markets not as a short-term tactical move, but as a strategic, long-term component of a comprehensive wealth plan.

New Structures, New Access

As interest in private markets grows, so does innovation in fund structures designed to meet investor needs. Until recently, private markets were largely inaccessible to individual investors due to high minimums, complex paperwork and long lockup periods. But new fund structures like interval funds are democratizing access by lowering minimum investments, simplifying documentation and providing regular opportunities to redeem shares.

Registered under the Investment Company Act of 1940, interval funds provide daily NAVs and provide investors quarterly opportunities to redeem their investments. This adds transparency and a level of liquidity not typically available in private markets, making them a practical entry point for individual investors. However, redemptions are usually limited to 5% of the fund’s value each quarter and withdrawals may be reduced if demand is high.

This structure makes manager selection especially important. In private credit, for example, experienced managers build portfolios with staggered loan maturities, strong protections in agreements and diversified borrowers. These features help generate more predictable cash flow and improve liquidity management.

The Next Generation Of Investors

This evolution in access comes at a pivotal moment. A generational shift in wealth and investor expectations is reshaping how advisors approach portfolio construction. We are on the verge of one of the largest wealth transfers in history, with Cerulli estimating $124 trillion in wealth transferred by 2048. This shift goes beyond the transfer of assets. It marks a change in how younger generations who are skeptical about traditional 60/40 portfolios think about investing.

Bank of America says 72% of investors aged 21 to 43 believe “it is no longer possible to achieve above average investment returns by investing solely in traditional stocks and bonds.”

These investors are tech savvy and looking for innovation, earlier-stage growth and access to investments that were once exclusive to institutions. Many of today’s most transformative companies generate substantial value while still private. OpenAI, for example, was recently valued at roughly $500 billion without being publicly listed. Through carefully selected investment vehicles and disciplined portfolio allocations, advisors can help qualified investors access new sources of innovation.

Making Private Markets Part Of A Core Allocation

Advisors who incorporate private markets into their clients’ portfolios are not chasing performance but responding to a new set of expectations and realities. A well-structured allocation, such as 15%, can capture many of the benefits while preserving financial flexibility. The key considerations are proper allocation, careful manager selection and a clear grasp of each client’s liquidity needs and financial goals.

Private markets are becoming a fundamental component of portfolio construction. In my experience, embracing change with a forward-looking approach is critical to building portfolios that stand the test of the markets and advisory practices that stand the test of a competitive marketplace.

Christian Chan is the Chief Investment Officer of AssetMark.