Private markets, once limited to institutions and ultra‑high net worth investors, are now becoming a meaningful part of modern portfolios as advisors look for new ways to diversify, generate income and support long-term growth. According to our Advisor Insights Survey, 91% of advisors say access to private markets is critical for differentiation.

While this momentum may have advisors and investors alike looking to rush in, private markets are not appropriate for every investor, and a one-size-fits-all approach could carry risks for some clients. High dispersion in returns, limited liquidity and operational complexity reinforce the need for discipline and selectivity – meaning the real opportunity for advisors lies in incorporating private markets in a way that is consistent with client goals and objectives.

By pairing judgment on client suitability with the diligence and infrastructure needed to implement these strategies thoughtfully, advisors can responsibly expand private market access and position themselves to serve the next phase of high-growth clients.

Private Markets Are Now A Strategic Imperative For Advisors

In an increasingly crowded advisory landscape with evolving client expectations, advisors are undergoing pressure to differentiate their value propositions and deliver more sophisticated solutions alongside traditional portfolio construction. The advisors who can deliver a broader toolkit – including private markets, tax management and advanced planning – will be better positioned to meet rising client demands and stand out in a competitive marketplace.

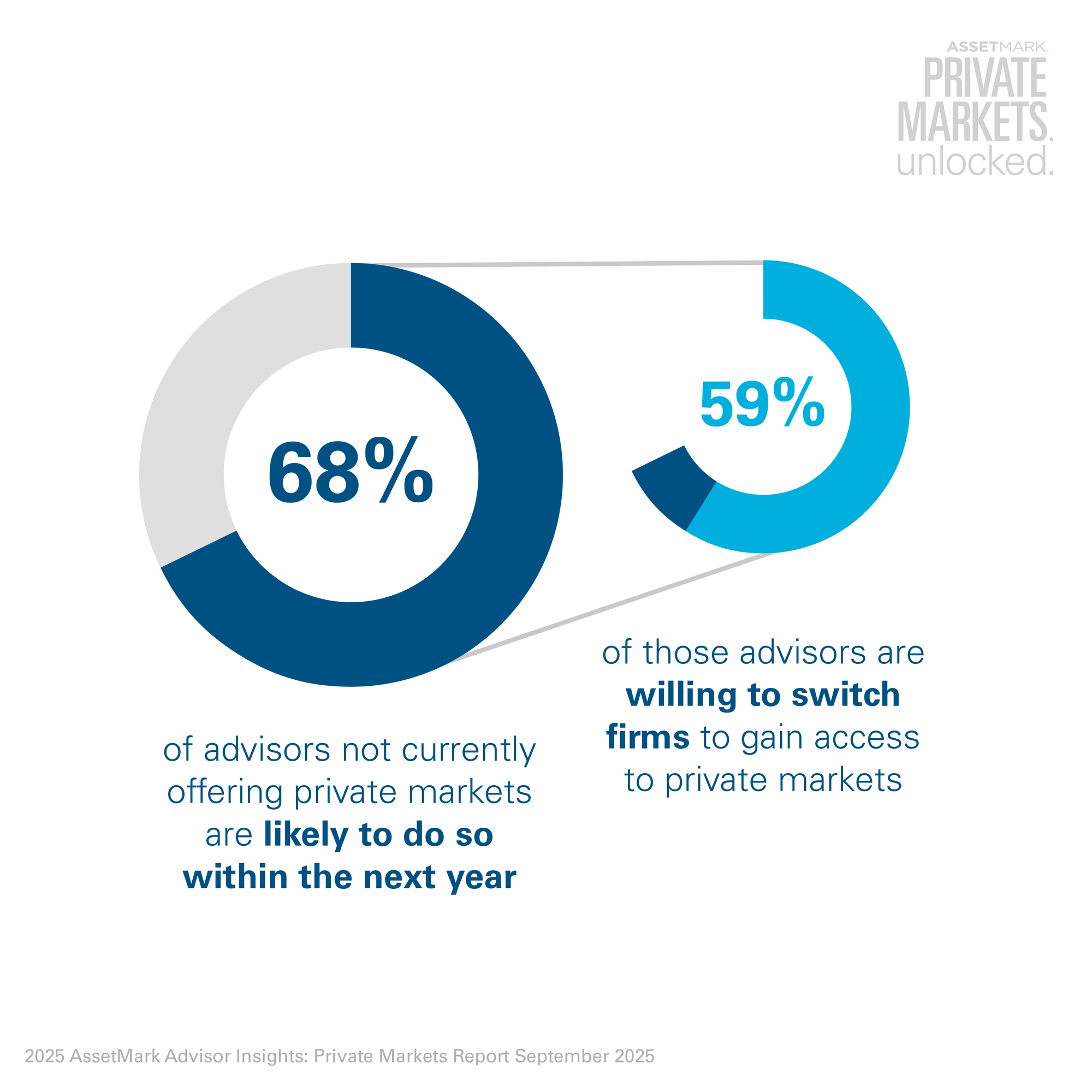

Our private markets survey echoes that imperative – with 83% of advisors who are currently providing private markets expecting allocations to increase over the next three years. Among those not yet offering these investments, 68% plan to add them within the next year and 59% of that group would consider switching firms to gain access.

The Investor Segments Driving The Next Phase Of Demand

Broader access to private markets can enable advisors to better serve high-growth, high-value client segments for whom these investments are a strategic fit. Because private markets require longer time horizons, liquidity, flexibility and additional education, the most compelling opportunities arise at the intersection of time and wealth.

One such segment is younger investors who are more comfortable allocating to non-traditional investments and are starting to inherit significant wealth. As part of the Great Wealth Transfer, a massive shift of assets is expected to pass from older generations to their heirs over the next several decades.

These investors, largely millennials and Gen X, typically have longer investment horizons and, in many cases, a higher tolerance for risk. With decades ahead of them, they are better positioned to accept some degree of illiquidity in exchange for long-term return potential and diversification benefits.

Another critical segment is emerging and existing high net worth households – those individuals or families who have built, or are on a clear trajectory to build, meaningful investable wealth. These investors have fewer liquidity needs, which positions them to take advantage of opportunities in longer-term holdings that historically have offered greater return potential than other asset classes. These investors are actively seeking advisors who can deliver a more complete and sophisticated set of solutions.

While these client segments have characteristics that make them strong candidates for private market strategies, access must be paired with the right infrastructure platform to thoughtfully integrate them into portfolios and keep pace with demand.

Barriers That Limit Access – And How Advisors Can Address Them

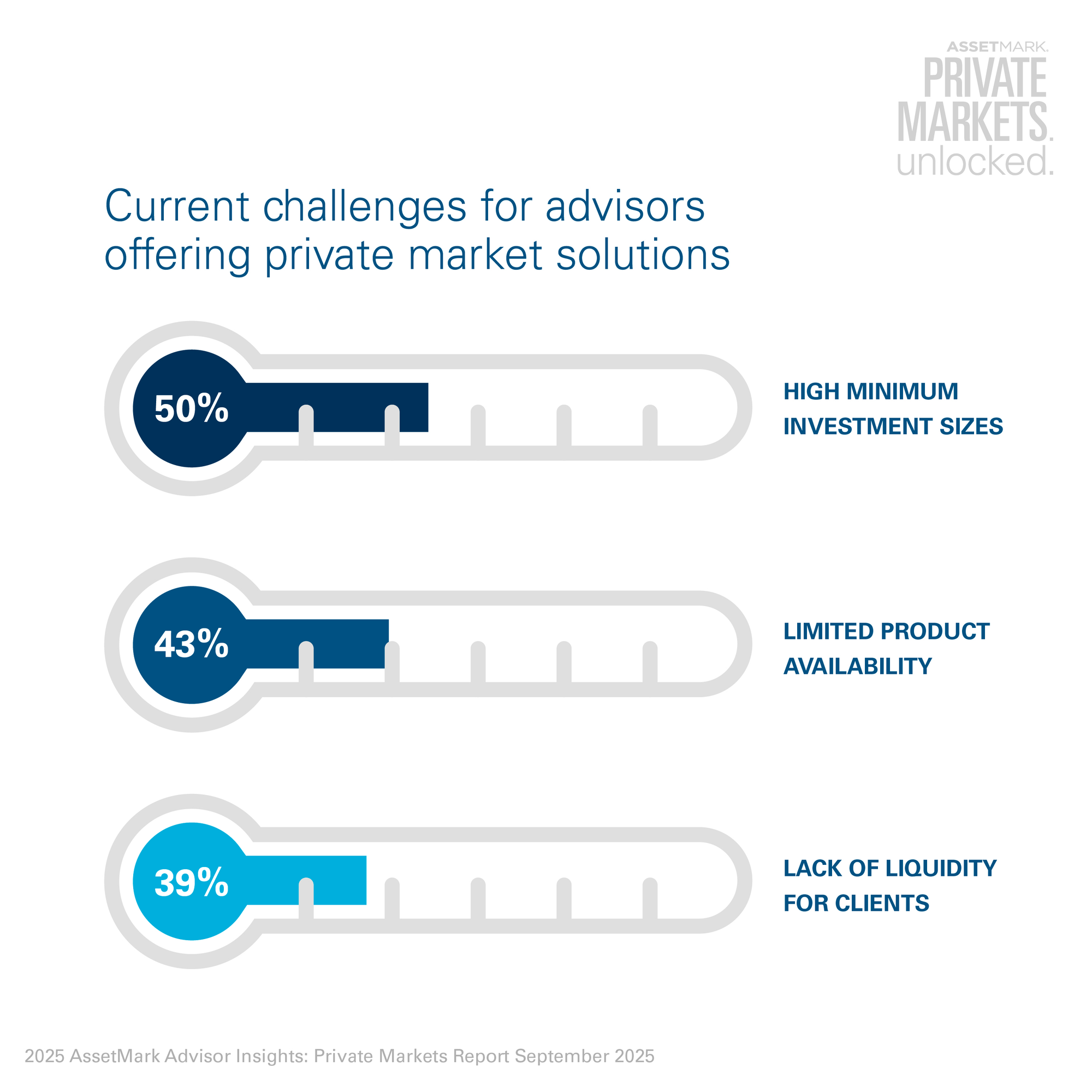

While demand is rising quickly, several practical barriers still limit broader adoption of private markets. According to our Advisor Insights Survey, high minimums (50%) and limited liquidity (39%) are among the most cited challenges for advisors providing access to private market solutions, particularly among clients with under $1 million in investable assets. Advisors overall emphasized the need for better investor education (50%), greater transparency and improved ease of use (48%) to help more clients participate in these strategies.

These barriers reflect the reality that most private market solutions were originally built for institutional investors, not for advisory practices serving a broad range of household needs and risk profiles. When advisors must independently manage due diligence, portfolio integration, operational workflows and client education, adoption naturally lags.

Integrated, purpose-built technology platforms can help close this gap. These platforms can combine professional management and due diligence with portfolio construction tools and robust educational content that make it easier for advisors to explain the implications of adding private markets on total portfolio performance and attributes in a way that clients understand.

By selecting a platform partner that can remedy the friction across private market investment selection, implementation, portfolio integration, education and communication, advisors can expand access thoughtfully, uphold suitability and enhance investor outcomes without adding unnecessary complexity. This alignment of demand, strategy and execution allows advisors to broaden access well beyond the ultrawealthy and better serve the next wave of high growth investors.

The Path Forward

Private markets are no longer a side conversation – they’re where client expectations are heading. But access doesn’t guarantee an overall better experience – guidance does – and therein is the opportunity for financial advisors. The advisors who enhance client goals with well‑designed private market solutions and support them with education and transparency will win the next generation of wealth.

David McNatt is an EVP and the Chief Wealth Solutions Officer of AssetMark.