With one presidential election debate under our belts, it’s clear that the months ahead could be riddled with bouts of volatility across financial markets. While the CBOE Volatility Index (VIX) remained subdued throughout much of the first half of 2024, history reveals that unease often unfolds as the general election date approaches.

Election-Year Volatility Historically Has Trended Up As November Nears

According to data from Bank of America Global Research, equity-market volatility has historically jumped from a tame annualized 14.7% in July of election years to a less steady 18.3% come November. Will the trend hold for the balance of 2024? Nobody knows for certain, but safeguarding a portfolio today could prove beneficial the further we progress into the campaign season. Structured notes are one such protective investment solution.

Each year and each market cycle is different, but research by Nationwide shows that 45% of investors believe 2024’s political developments could be particularly impactful on retirement portfolios, beyond what the usual market swings deliver. Structured notes can meet this investor concern.

Understanding Structured Notes

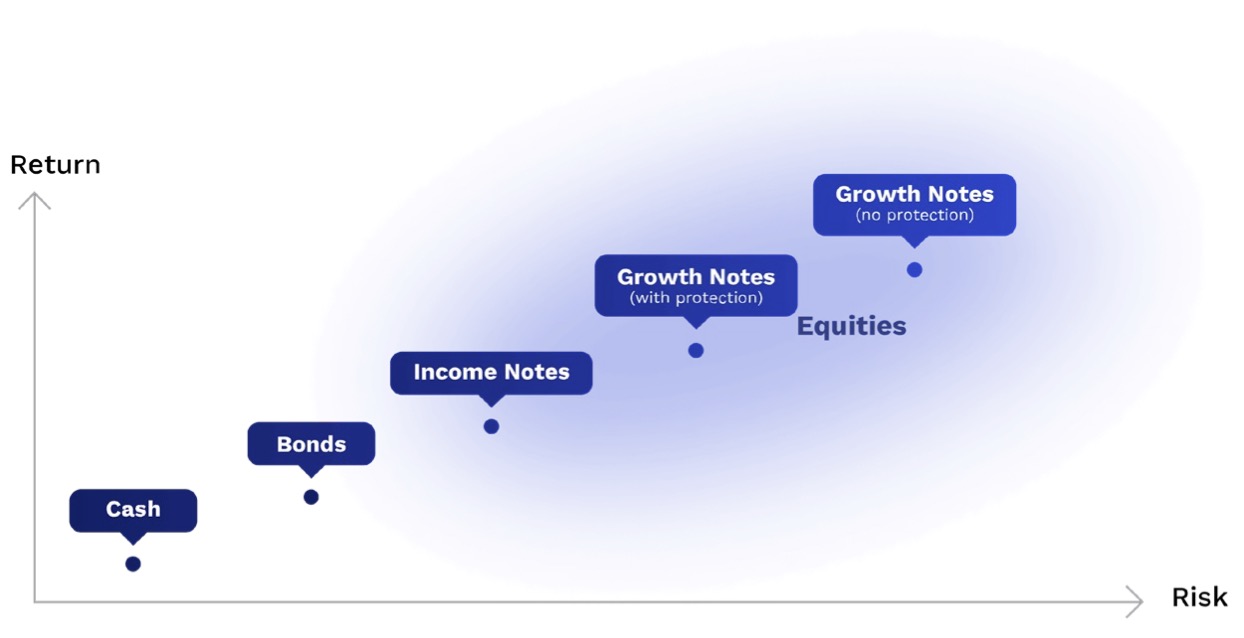

Structured notes are designed to tailor a client’s portfolio to a desired risk-and-return profile. A structured note is a straightforward vehicle – if you know how stocks, bonds and options work, then you can grasp notes, too.

Issued by a bank, they combine a debt security with a derivatives package and may be appropriate for a range of investors, particularly those concerned about market volatility. The performance of a note can be linked to a variety of assets or markets, including equities, commodities and interest rates.

There are four primary characteristics of structured notes:

Downside protection.

Structured notes commonly offer a buffer against downside price action in the stock market. The options package is the piece that manages possible losses. So long as the underlying asset is not down more than a stated protection amount, the investor receives their principal back at the note’s maturity.

There are two protection types: hard and soft. Hard protection is the more conservative type, which acts as a buffer against losses. For instance, if the underlying asset’s price breaks the protection level, the investor is only exposed to losses past the protection percentage. Soft protection, on the other hand, is like a barrier. If the protection level is breached, the holder is exposed to the full losses of the underlier.

As you might guess, notes with soft protection generally offer more upside return potential than those with hard protection.

Upside participation.

Derivatives are also used to provide potential returns linked to the underlying asset. Structured notes often come in two forms: income and growth. While the former offers a fixed return level with periodic coupon payments, the latter gives holders a level of upside participation, usually a return up to a cap on an index like the S&P 500.

Risk management.

Here’s where structured notes can really prove their worth. By combining protective investments, like structured notes, into a diversified portfolio, an investor can reduce their allocation’s overall volatility. Depending on the client’s risk-and-return objectives, a note can be crafted in a number of ways. This versatility makes notes ideal for managing market uncertainty.

Enhanced returns.

Investors seeking to capitalize on uptrends in an underlying asset can purchase growth notes that return a multiple of an underlying asset’s performance over a stated period. While income notes focus on offering a high yield with downside protection, growth notes with enhanced upside potential are generally geared toward investors with a higher risk tolerance. It’s important to recognize that each note has a maturity date, usually a duration of six months to five years.

Incorporating Structured Notes Into Client Portfolios: Walking Through An Example

There are a range of possible investment management strategies and use cases for structured notes. Advisors may find them appropriate for many client types, but we find that retirees and those approaching retirement are the most interested in this vehicle.

Walking through an example, suppose a retiree has a standard 60/40 allocation in a $1 million portfolio. If she takes 15% from the stock portion and purchases a growth note linked to the S&P 500, it’s possible to reduce overall portfolio volatility while retaining a comparable level of upside return potential.

After reallocating, the portfolio holds $450,000 in stocks, $400,000 in bonds and $150,000 in a growth note. We’ll assume the growth note has hard protection against the first 15% of market losses and an enhanced upside participation rate.

If the stock index drops 15% and the bond market falls 5%, the original stock portfolio’s loss is $90,000. The equity portfolio with the growth note, however, would be down just $67,500.

| Portfolio Component | Original Portfolio Value | Portfolio With A Note | Loss In Original Portfolio | Loss In Portfolio With A Note |

|---|---|---|---|---|

| Stocks | $600,000 | $450,000 | ($90,000) | ($67,500) |

| Bonds | $400,000 | $400,000 | ($20,000) | ($20,000) |

| Growth Note | - | $150,000 | - | $0 (protected) |

| Total | $1,000,000 | $1,000,000 | ($110,000) | ($87,500) |

By reallocating part of the equity sleeve to a growth note, the overall loss can be reduced. This protection, combined with the potential for an enhanced upside, can make structured notes an effective tool for managing volatility.

Jason Barsema is Co-Founder and President of Halo Investing.