Every industry needs specialists – those professionals who come from a unique place of distilled knowledge and experience – to serve the rest of the industry in meeting challenges. In wealth management, consultants and subject matter experts of various backgrounds provide the extra guidance needed for advisors, RIAs and others to manage difficult situations or catalyze growth.

Today WSR honors the top professional services firms in the wealth management industry – those firms that have consistently brought specialized capabilities to bear and, in doing so, made a broad impact in the industry. In arriving at the honorees, our team reviewed many outstanding professional services firms for industry impact, reputations for excellence and demonstrated leadership. Some of the firms recognized today are boutique to wealth management, while others operate in multiple industries with a team dedicated to ours.

The recognized firms are set out alphabetically. Please join us in congratulating the PRO 5: Top Wealth Management Professional Services Firms.

CEG Worldwide

Founded 24 years ago by CEO John Bowen, CEG Worldwide helps financial advisors serve affluent clients through coaching programs and empirical research designed to build streamlined wealth management practices that attract and serve high net worth clients well.

The company’s flagship programs – Elite Wealth Manager and Roundtable Mastermind – have demonstrated the ability to increase advisors’ assets under management, revenue, client satisfaction, operational efficiencies and profits. Its data-driven approach leverages CEG Insights, its research arm that studies the affluent market and best practices of top-performing advisors.

Its recently launched Virtual Family Office employs technology and specialized experts to enable advisors to provide clients with a level of services usually available only to ultra-high net worth clientele.

The firm uses a holistic approach that emphasizes not only the businesses but also the lives of advisors, clients and teams for the good of both advisors and the industry.

“Advisors across the industry often find themselves in CEO roles as they achieve success, without adequate leadership training and underestimating the importance of team dynamics,” Bowen said, addressing typical gaps in strategy and planning. “This blind spot leads to inefficiencies and substantial missed opportunities. Embracing a ‘dream team’ mentality unlocks a practice’s full potential.”

Fusion Financial Partners

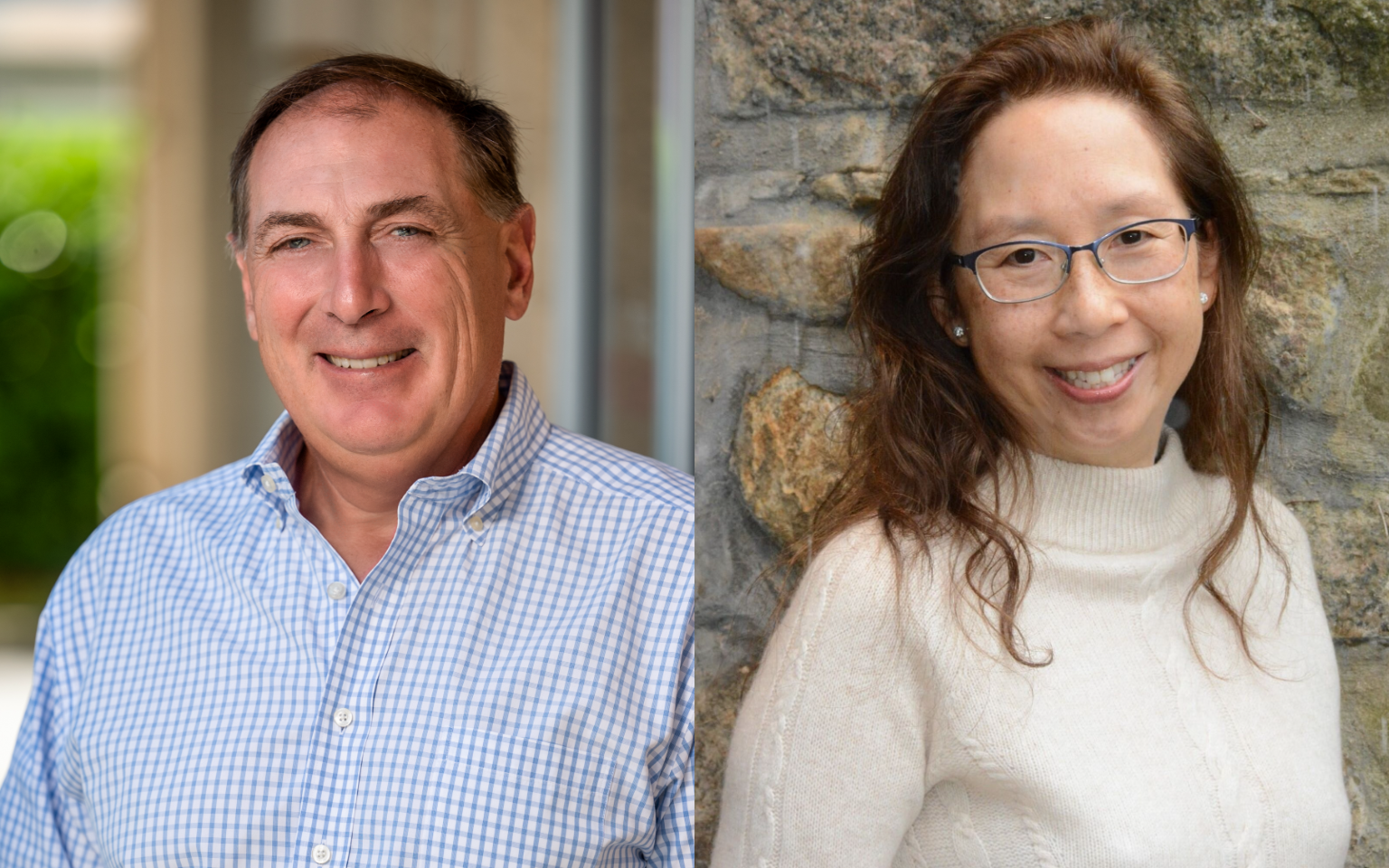

After nearly two decades in the independent advisor space, Mike Papedis launched Fusion Financial Partners in 2017 to help advisor teams navigate the pathway to independence and reduce time needed to establish their own RIA. Mike is joined at Fusion by his business partner and wife, Kimberly Papedis, who brings over two and a half decades of industry experience to the firm.

The core specialization of Fusion is acting as the chief architect and outsourced chief operating officer for advisors who would benefit from proven RIA build expertise and negotiating support on their journey to launch their own RIA.

Fusion created two proprietary processes, Fusion BlackOps, for breakaway teams, and Fusion RIA Master Builder Services, to lead advisor teams and key stakeholders through the RIA build process. The processes include pre-design consultation, visioning workshops, schematic design, design development, contracting and negotiations, project administration and post-transition operational coaching and support.

The Fusion leadership team boasts executive-level experience at predecessor firms including HighTower Advisors, Wells Fargo FiNet, Raymond James and Fidelity Investments, where both Kimberly and Mike held a variety of leadership roles in supporting independent advisors.

In 2024, they consulted on the successful launches of RIA firms Serenus Wealth Advisors, Outrunner Capital and GreyKasell. Other RIAs Fusion supported include Chicago Capital, Performance Wealth Partners and Thrivent Advisor Network.

The Fusion team has moved over $35 billion in client assets to the independent space.

“The key for advisors is to find an expert guide to lead through the critical design decisions of launching a custom-made RIA firm,” said Mike Papedis. “Just as important, having a safe venue to learn the truths about independence and the nuisances of the vendor landscape is vital education.”

He continued, “With the right partners in place, typical worries such as compliance, technology, sources of revenues, investment research, marketing and employee benefits become exciting opportunities and distinguishing strengths of the new RIA firm.”

GreenLine Consultants

GreenLine Consultants provides strategic insight and implementation expertise to leaders for the delivery of business and technology initiatives, with a focus on speed. The firm’s partners provide a depth of experience in growing, optimizing and transforming businesses combined with subject matter expertise. The firm serves a variety of client needs from developing a strategic vision, to executing specific plans, to solving specific challenges, with clients including RIAs, independent broker-dealers and hybrid firms.

“In our experience, a sound transition strategy and detailed plan with clear delivery dates must prioritize client experience and include technology decisions, client communications, custodian coordination, legal and risk changes, business updates, resource planning and more,” the firm stated to WSR. “When it comes to implementation, we see the devil is in the details.”

GreenLine aims to expedite time to market and improve ROI by focusing on advisor services, including succession planning and business development; operational infrastructure to build strong foundations for growth; and enhancements to onboarding practices.

“Consultants bring diverse experience and industry connectivity, providing an outside-in perspective on client challenges,” said Mark Guglielmo, Founding Partner at GreenLine, addressing how wealth management clients can benefit from consultants with experience across multiple industries. “This approach generates innovative solutions that clients may not consider with their current resources. For small firms, it may mean tailoring sophisticated technology solutions, while larger firms may benefit from fresh perspectives and strategies to expedite delivery.”

Guglielmo added that GreenLine “is committed to turning strategy into action; our combined decades of expertise in strategic design and hands-on implementation help firms navigate challenges effectively, optimize operations and enhance business outcomes.”

The Hamburger Law Firm

Founded by Chief Counsel Brian Hamburger in 2000, The Hamburger Law Firm supports business endeavors in and around the wealth management profession, throughout their entire lifecycle. They counsel startup investment advisors; architect the employment transition for accomplished financial advisors; and represent established investment advisors, financial technology firms, broker-dealers, funds and their corresponding service providers as they navigate a broad array of complex issues faced by growing enterprises in this highly regulated space.

The firm sits at the nexus of many important and high-profile business transactions in the industry. It has built a culture that emphasizes freedom for attorneys to be passionate about the impact that their work has on the industry and recognizes their dedication and commitment to clients. While the firm maintains absolute discretion, it is involved in many of the industry’s successful breakaways, large-scale launches and business transactions.

Addressing the most urgent legal need that advisors are generally unaware of today, Brian Hamburger said, “While there is no shortage of important issues, perhaps the most urgent is the impact of cybercrime and its threat to so quickly erode the client trust that this profession relies upon.”

He explains, “Soon be a $10.5 trillion annual business, the wealth management industry is becoming an ever-more compelling target due to the ability for criminals to scale their crimes, thanks to the decreasing cost of technology and increased capabilities of artificial intelligence. With the SEC and other regulators poised to issue new regulations, it will be yet another reason for investment advisors to reallocate resources and fortify their cybersecurity protections.”

Wipfli

Wipfli is a top 25 advisory and accounting firm that provides holistic solutions to help clients navigate the marketplace, optimize performance and drive growth. In the wealth management space, Wipfli’s Wealth & Asset Management Industry Practice, led by Partner Paul Lally, provides guidance to firms that have outgrown their traditional service providers.

The firm provides a suite of technology, consulting and tax offerings designed to help growing businesses evolve into high performing companies, with a goal of achieving more viable, sustainable, stable and profitable growth practices through a depth of industry knowledge and subject matter expertise from its over 3,200 associates.

Its Wealth & Asset Management Industry Practice aims to provide services that are both personalized and robust to clients with a boutique, industry-specific experience supported by a large national firm.

Lally says that Wipfli is seeing increased demand from wealth and asset management firms for “better hyper-personalization tools, as well as digital connectivity and engagement capabilities,” as they endeavor to accelerate organic growth, attract and retain clients, and work with Next Gen clients as well as baby boomers.

He added that there is also much interest from wealth and asset management firms “around generative AI and AI readiness, which involves data architecture and clean data analytics. Many businesses have already invested in technology, now they need guidance around integrating and optimizing that technology.”

Julius Buchanan, Editor in Chief at Wealth Solutions Report, can be reached at jbuchanan@wealthsolutionsreport.com.