After three years of the Future Proof Festival in Huntington Beach, California, the event organizer initiated an East Coast version in Miami Beach, with the inaugural Future Proof Citywide from March 16 to 19 drawing over 2,500 attendees from 13 countries. WSR covered the event on location.

We spoke with Michael Purcell, Managing Director, Sales and Business Development at wealthtech firm Canoe, who told us, “Alts and AI are hot topics at this conference. We’re innovating in this space, applying cutting edge AI technology and LLMs [large language models] to automate processes” of compiling, organizing and delivering data on private markets products to advisors.

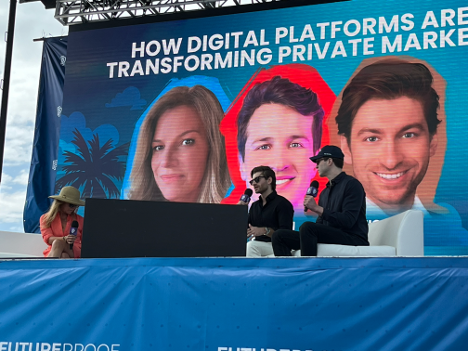

Digital Platforms Transforming Private Markets

Arch is another firm that engages in similar work, and its Co-Founder and CEO, Ryan Eisenman, took the stage Monday afternoon for a panel discussion titled, “How Digital Platforms Are Transforming Private Markets,” with Michael Maroon, Managing Director at GLASfunds, moderated by Amy DeTolla, Founder and CEO of Aureus Advantage.

DeTolla challenged the panel: “Advisors don’t know where to start,” she said. “They don’t know how to begin the task to get into this asset class with scalable products.”

Maroon set out some of the inefficiencies that may cause problems, such as bottlenecks in allocation to alts and difficulty in diversification. Much progress has been made, according to Maroon, on allowing more diversification by lowering minimum investments, which have in many cases come down from millions to as low as $25,000. However, the onboarding process is manual and labor intensive, with many subscription document sets needing days of work to fill out 60 to 80 pages of forms.

He also said that second to subscription documents, voluminous KYC/AML paperwork can create large burdens. His firm provides solutions to minimize both of these burdens.

Eisenman pointed out difficulties with ongoing reporting. As a firm provides a broader number of alts to clients, or onboards clients with existing alts, the resulting dozens to hundreds of individual platforms with unique workflows can slow processes significantly. Often, he said, advisors don’t have full visibility into what’s happening in their client portfolios due to this issue.

DeTolla pointed out the importance of scale to any solution. Maroon agreed, noting that “data chaos” can only be managed by scalable solutions.

Eisenman added that he knows of instances in which advisors could not onboard new clients because of the complexity of the alts they would bring with them.

DeTolla pointed out that for aggregators and other firms that are involved in M&A transactions, disparate platforms can create significant problems integrating acquired firms. Once several firms have been acquired, the number of alts platforms the acquiror needs to monitor and report on multiply. She said that she knew of one acquiror that had to manage the data of 1,400 alts.

Blending Human And Digital

Later Monday afternoon, Craig Iskowitz, CEO of strategy consulting firm Ezra Group, led a panel discussion titled “The Future of Advice: Blending Human Expertise with Digital Innovation” with Ritik Malhotra, CEO of tech-based RIA Savvy Wealth, and Eden Ovadia, CEO of FINNY AI, a lead generation and prospecting solutions provider.

Ovadia and Malhotra both spoke of marketing as one area in which digital transformation is improving process and reducing human labor while providing better data on the target audience.

Malhotra added that technology, including AI, can help with development of marketing collateral, and make communications more relevant to the recipient by tailoring them to that person’s specific pain points.

Iskowitz presented a statistic that 60% to 70% of an advisors’ time can be taken by administrative tasks, asking how digital means can help reduce that burden.

Malhotra replied that technology can be used to free advisors’ time during onboarding, portfolio management and other processing work. He added that there’s a third category where technology can play a major role in boosting productivity: ad hoc work with clients. Where emails and research can become voluminous, AI can help create communications and provide research summaries to cut advisors’ workloads. He said that his firm can help advisors free between 11 and 19 hours per week.

Iskowitz asked the panel how the industry can move away from prompt engineering for AI, which he said, “turns us into engineers.”

Agreeing with Iskowitz, Ovadia noted an instance when her tech-focused team developed prompt engineering tools during an earlier stage of their history and thought the tools helped tremendously, but discovered that when presenting the solution to advisors, many would choose more basic forms of interface such as drop-down menus.

Malhotra said that you “must meet advisors where they work,” and the challenge to firms is to develop prompts patterned on the plain English statements that advisors and other professionals in the industry use to communicate to colleagues.

Iskowitz asked the panelists if AI will ever replace advisors, to which Malhotra responded that it “will never happen, because AI will never be 100% accurate.” There must always be human subjectivity involved, according to Malhotra. He added that AI will not have good social skills, and the human client’s need to have someone explain financial matters must be filled by a human.

Instead of reducing the number of an advisor’s assistants through automation, Ovadia’s goal is to increase an advisor’s business so much that the advisor will have to hire more assistants.

Agreeing, Ovadia said that emotional intelligence is required to interact with clients. She added that instead of reducing the number of an advisor’s assistants through automation, her goal is to increase an advisor’s business so much that the advisor will have to hire more assistants.

On the subject of quantum computing, Malhotra said that at the current time it is not relevant to wealth management. Iskowitz added that the technology could disrupt the industry because current encryption measures are based on modern computing speeds. Quantum computing could require the industry to adopt much stronger encryption measures.

Julius Buchanan, Editor in Chief at Wealth Solutions Report, can be reached at jbuchanan@wealthsolutionsreport.com.